All Categories

Featured

Table of Contents

Eliminating agent payment on indexed annuities enables for dramatically higher illustrated and actual cap prices (though still markedly lower than the cap prices for IUL plans), and no uncertainty a no-commission IUL plan would certainly press illustrated and actual cap prices higher. As an apart, it is still feasible to have a contract that is extremely rich in representative settlement have high very early cash money surrender worths.

I will certainly acknowledge that it goes to the very least theoretically POSSIBLE that there is an IUL policy out there provided 15 or 20 years ago that has provided returns that transcend to WL or UL returns (more on this below), yet it is essential to much better understand what a proper comparison would certainly involve.

These policies typically have one bar that can be evaluated the business's discernment annually either there is a cap price that specifies the optimum attributing price in that specific year or there is an engagement rate that defines what percent of any positive gain in the index will be passed along to the policy because specific year.

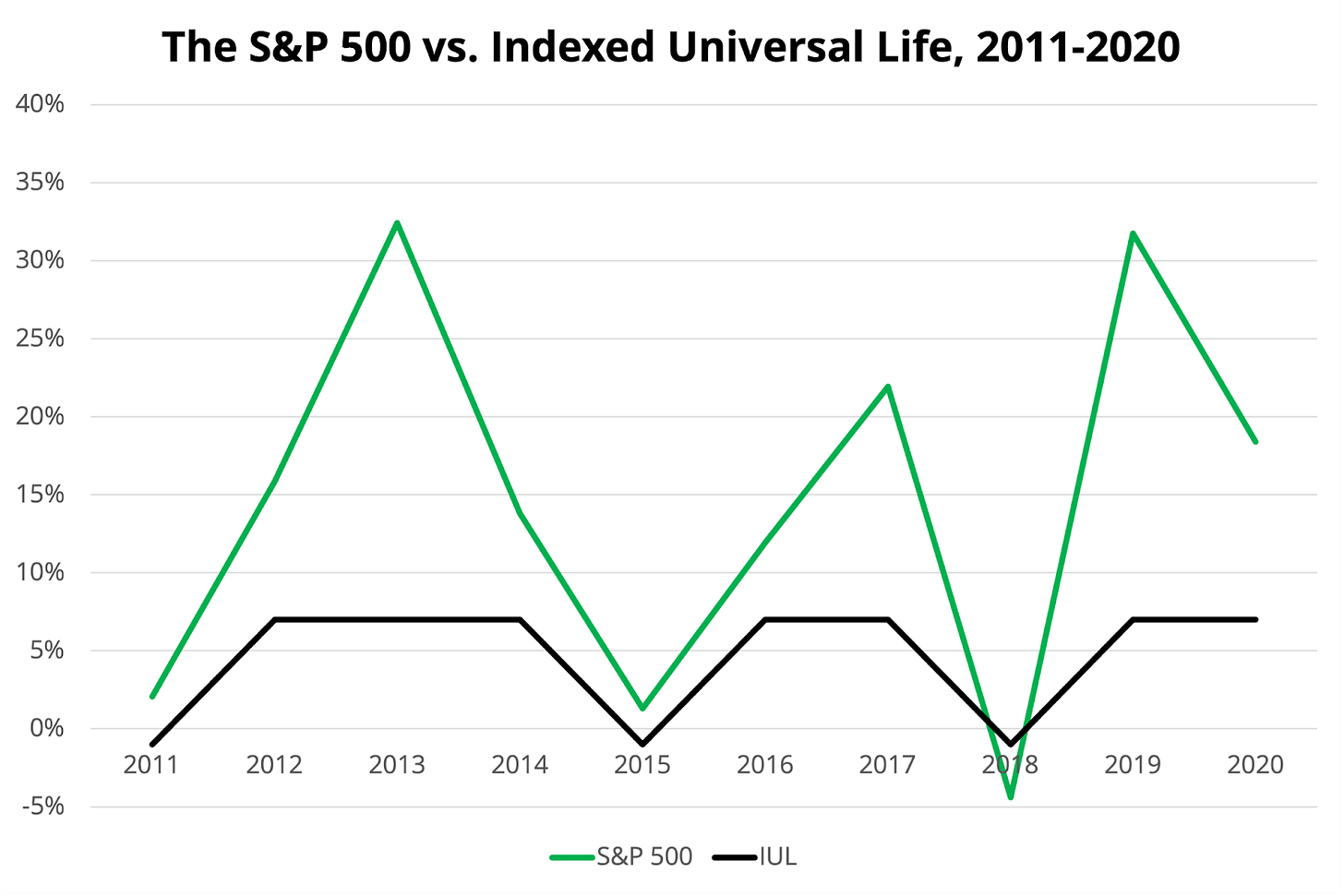

And while I usually concur with that characterization based on the mechanics of the plan, where I take issue with IUL proponents is when they define IUL as having exceptional returns to WL - eiul insurance. Lots of IUL advocates take it an action additionally and point to "historical" data that seems to sustain their cases

First, there are IUL plans out there that bring more threat, and based upon risk/reward principles, those policies must have greater expected and real returns. (Whether they in fact do is a matter for serious dispute but business are utilizing this approach to assist justify higher detailed returns.) For instance, some IUL plans "double down" on the hedging method and assess an additional cost on the plan yearly; this cost is then made use of to increase the alternatives budget plan; and after that in a year when there is a favorable market return, the returns are amplified.

Guaranteed Universal Life Insurance Companies

Consider this: It is feasible (and in fact most likely) for an IUL plan that standards an attributed rate of say 6% over its very first one decade to still have a total negative price of return throughout that time because of high costs. Lots of times, I locate that agents or consumers that boast about the efficiency of their IUL plans are confusing the attributed price of return with a return that properly mirrors all of the policy bills.

Next we have Manny's concern. He states, "My pal has actually been pressing me to purchase index life insurance coverage and to join her company. It looks like an online marketing. Is this an excellent concept? Do they really make just how much they say they make?" Let me start at the end of the question.

Insurance salespersons are not poor people. I used to sell insurance coverage at the beginning of my occupation. When they market a costs, it's not uncommon for the insurance policy firm to pay them 50%, 80%, also occasionally as high as 100% of your first-year costs.

It's difficult to market because you got ta constantly be seeking the next sale and mosting likely to locate the next person. And specifically if you do not really feel really founded guilty about the thing that you're doing. Hey, this is why this is the very best service for you. It's going to be difficult to find a great deal of fulfillment because.

Allow's talk about equity index annuities. These points are popular whenever the markets are in an unpredictable period. You'll have abandonment periods, commonly seven, 10 years, perhaps also past that.

Universal Life Insurance With Living Benefits

That's exactly how they recognize they can take your money and go completely invested, and it will certainly be okay because you can not obtain back to your cash up until, once you're into seven, ten years in the future. No matter what volatility is going on, they're probably going to be great from an efficiency viewpoint.

There is no one-size-fits-all when it comes to life insurance. Obtaining your life insurance policy plan best takes into account a number of factors. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your busy life, economic independence can feel like an impossible objective. And retired life might not be top of mind, due to the fact that it appears so much away.

Fewer companies are offering conventional pension plans and lots of companies have lowered or ceased their retired life plans and your capability to depend only on social safety is in question. Also if advantages have not been minimized by the time you retire, social security alone was never meant to be sufficient to pay for the way of living you desire and are entitled to.

Level Premium Universal Life Insurance

Now, that may not be you. And it's vital to know that indexed universal life has a great deal to offer individuals in their 40s, 50s and older ages, in addition to individuals who intend to retire early. We can craft a service that fits your specific circumstance. [video: An illustration of a man appears and his wife and child join them.

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Currently, expect this 35-year-old man requires life insurance to shield his family and a method to supplement his retirement earnings. By age 90, he'll have gotten virtually$900,000 in tax-free earnings. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And should he die around this moment, he'll leave his survivors with more than$400,000 in tax-free life insurance benefits.< map wp-tag-video: Text boxes show up that read"$400,000 or more of protection"and "tax-free revenue with policy finances and withdrawals"./ wp-end-tag > In truth, throughout all of the accumulation and dispensation years, he'll get:$400,000 or even more of protection for his heirsAnd the opportunity to take tax-free income with policy fundings and withdrawals You're probably wondering: How is this possible? And the response is easy. Rate of interest is tied to the performance of an index in the securities market, like the S&P 500. But the cash is not directly spent in the securities market. Interest is credited on a yearly point-to-point sections. It can offer you extra control, flexibility, and alternatives for your financial future. Like many individuals today, you may have accessibility to a 401(k) or various other retirement. And that's an excellent very first step in the direction of conserving for your future. Nevertheless, it's important to understand there are limits with certified plans, like 401(k)s.

And there are constraints on when you can access your money without fines. [video: Text boxes appear that read "limits on contributions", "restrictions when accessing money", and "money can be taxable".] And when you do take cash out of a certified strategy, the cash can be taxable to you as revenue. There's a great factor so many individuals are transforming to this distinct remedy to address their economic objectives. And you owe it to on your own to see exactly how this can help your own individual circumstance. As component of an audio monetary method, an indexed universal life insurance policy policy can aid

Iul Retirement Calculator

you handle whatever the future brings. And it supplies unique capacity for you to construct substantial cash money worth you can make use of as additional earnings when you retire. Your cash can grow tax obligation delayed with the years. And when the policy is designed correctly, distributions and the survivor benefit won't be taxed. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is very important to talk to an expert agent/producer who comprehends just how to structure a service similar to this effectively. Prior to committing to indexed universal life insurance, right here are some pros and cons to consider. If you choose a good indexed global life insurance coverage plan, you might see your cash money worth expand in worth. This is practical due to the fact that you may have the ability to accessibility this cash prior to the strategy expires.

Because indexed global life insurance coverage requires a particular level of danger, insurance policy business have a tendency to maintain 6. This type of strategy also offers.

Typically, the insurance company has a vested rate of interest in carrying out better than the index11. These are all aspects to be thought about when selecting the finest kind of life insurance for you.

Nevertheless, because this kind of plan is much more intricate and has a financial investment part, it can typically come with greater premiums than other plans like entire life or term life insurance policy. If you don't believe indexed universal life insurance policy is ideal for you, below are some choices to take into consideration: Term life insurance policy is a short-lived plan that typically uses insurance coverage for 10 to 30 years.

Index Life Insurance Pros And Cons

When determining whether indexed universal life insurance policy is ideal for you, it is necessary to consider all your options. Entire life insurance policy may be a much better choice if you are looking for even more security and uniformity. On the other hand, term life insurance policy might be a far better fit if you just need insurance coverage for a certain amount of time. Indexed global life insurance policy is a kind of plan that supplies extra control and adaptability, together with greater cash money value growth capacity. While we do not supply indexed universal life insurance coverage, we can give you with even more information about whole and term life insurance policy plans. We advise exploring all your alternatives and talking with an Aflac representative to discover the very best fit for you and your household.

The rest is included in the cash value of the plan after fees are deducted. The cash money value is attributed on a regular monthly or yearly basis with rate of interest based on boosts in an equity index. While IUL insurance might verify valuable to some, it is essential to understand exactly how it works before acquiring a policy.

Latest Posts

Universal Life Cash Value Calculator

Indexed Universal Life Insurance Vs Term

Life Insurance Cost Index